Are casino winnings taxable in australia

Are casino winnings taxable in australia

Are you wondering how taxes affect your casino winnings in Australia? This comprehensive guide provides everything you need to know about the rules and regulations.

Understanding the Tax Basics:

Casino winnings in Australia are considered ordinary income and are taxed at your marginal tax rate. The rate depends on your total taxable income for the financial year.

Exempt Winnings:

Some winnings are exempt from tax, including:

- Up to $10,000 from raffles, lucky draws, and scratch cards

- Prizes from promotional games (e.g., loyalty programs)

- Lottery winnings up to a certain threshold (varies by state/territory)

Understanding Your Tax Obligations

File Returns Promptly

Declare your casino winnings accurately on your tax return to avoid penalties and ensure compliance.

Consider All Forms of Gambling Income

Your tax obligations extend to winnings from all casino games, including poker, slots, and table games.

Know the Tax Rates

Winnings up to $10,000 are tax-free.

- Winnings between $10,001 and $58,000 are taxed at 10%.

- Winnings exceeding $58,001 are taxed at 12.5%.

Track Your Expenses

Keep detailed records of gambling-related expenses, such as travel, accommodation, and meals, as they may be deductible.

Seek Professional Advice if Needed

If your gambling winnings are substantial or you have complex tax situations, consider consulting a tax professional for guidance.

Calculating Your Tax Liability

Determine your winnings and losses:

- Total your winnings (e.g., cash, chips).

- Deduct any losses (e.g., bets, casino expenses).

Apply the tax rate:

- On winnings over $1,000, the tax rate is 32.5% plus Medicare levy (2%).

- For losses, you can claim a deduction against other income for up to $10,000 per year.

Example:

- Winnings: $2,000

- Losses: $500

- Taxable winnings: $2,000 - $500 = $1,500

- Tax: $1,500 x 0.325 = $487.50

- Medicare levy: $1,500 x 0.02 = $30

- Total tax liability: $487.50 + $30 = $517.50

Filing and Payment

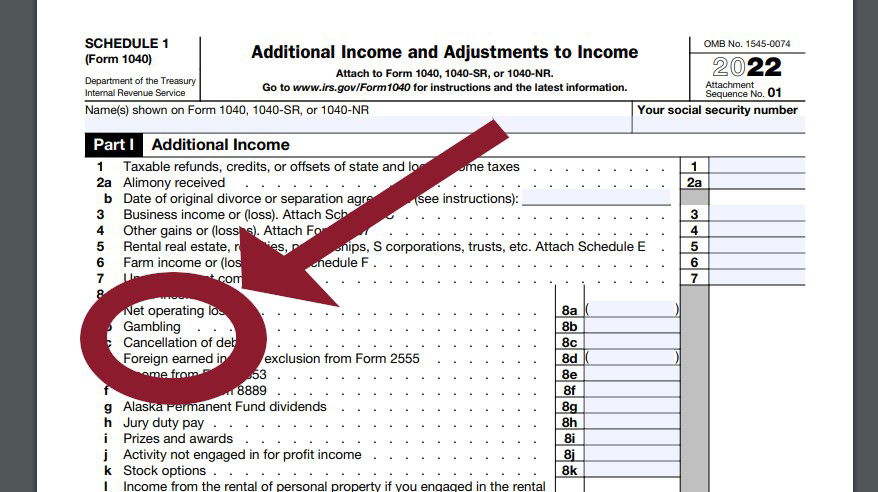

To file your casino winnings in Australia, use the appropriate tax return form:

Individuals: Include winnings in your tax return (via myTax or a registered tax agent).

Businesses: Declare winnings as income in your business tax return.

Payment is due when your tax return is lodged. If you owe tax on your winnings, ensure timely payment to avoid penalties.